Every person who is in receipt of the following income for which he is taxable must file a return of income if such income computed. New proposed section sub-section 4A of section 45 of the Act applies in a case where a specified person receives during the previous year any money or other asset at the time of.

Pin By The Taxtalk On Income Tax Deposit Accounting Cash

The CBDT or Central Board of Direct Taxes has announced the Finance Act 2018 wherein it has amended the Income Tax Acts Section 18.

. The dutiable amount of a deceased estate represents the sum of all property of the deceased and property which is deemed to be property of the deceased as at date of death less all deductions. Section 4 2 of Income Tax Act. 2 Act 1991 w.

For any intentional mistakes or omissions and. New proposed section sub-section 4A of section 45 of the Act applies in a case where a specified person receives during the previous year any money or other asset at the time of. Prior to the substitution sub- section 4A as inserted by the Finance Act 1983 w.

1- 4- 1984 read as under 4A Sub- section 1 or. However drastic changes have been done at the time of passing the bill. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

A special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA 1967 b deduction of tax from special classes of income and. Section 4A of the Income Tax Act 1967. Income Tax Return of Charitable and Religious Trusts.

Section 4A read together with Section 109B of the ITA means that payments of special classes of. A Division Bench of this court in Commissioner of Income Tax V. The special classes of income are those listed in section 4A of the Income Tax Act 1967 ITA.

In connection with the use of property or rights. In respect of income chargeable under sub-section 1 income-tax shall be deducted at the source or paid in advance where it is so deductible or payable under any provision. Please advice is there any capital gain if partner received excess money than his capital balance which comes in firm at the time of retirement.

While presenting the budget -2021 the proposal was there just to replace section 45 4 and introduce section 45 4A. Best Tax Saving Plans. I Amounts paid in consideration of services rendered.

It comes as a process to get claims made where the income of a. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act 1890. This is the only.

52 Pursuant to section 6 of the Finance Act 2017 Act 785 effective 1712017 income under paragraphs 4Ai and 4Aii of the ITA which is derived from Malaysia is chargeable to tax in Malaysia. 4A 51-52 Every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes or of income. Section 132 4A extracted 2.

Section 4A of the ITA provides for special classes of income on which tax is chargeable. 1997 225 ITR 686 held that if the Kuri business is held in trust the income therefrom would not be. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF.

Substituted by the Finance No. The problem that this paper will grapple with is to analyse section 4A of the Income Tax Act of Kenya. Income of a person not resident in Malaysia in respect of.

Section 1395 is specifically applicable to cases of Omissions and Wrong Statements and not meant for Concealment or False Statements. Commissioner of Income Tax 1. Payments received as consideration for services rendered by the nonresident or its employee in.

Exchange provisions of the Kenyan lncome Tax Act3 have remained exactly the same. Short title and commencement 2. Get Returns as high as 15.

The income spoken of in sub-section 4 is the gross income of the business undertaking and not the net income. 4A Where any books of account other documents money bullion jewellery or other valuable article or thing are or is found. Section 45 4a of income tax act.

It is evident that the amendment to section 454 is being proposed with a view to overcoming the difficulties in taxing the capital gains arising at the time of retirementreconstitution of.

Amazon Has Launched The Latest Feature With An Option That Allows Customers To Deal In Digital Gold The Name Of The Feature Is Gold Vault E Pharmacy Digital

Health Insurance Tax Benefits Health Insurance Plans Health Insurance Health Insurance Benefits

2015 2021 Form Irs 8822 Fill Online Printable Fillable Blank Pdffiller Money Template Change Of Address Irs

Title Students Guide To Income Tax 2017 Author Dr Vinod K Singhania Publisher Taxmann Price Rs 995 Vorabookhouse Student Guide Income Tax Student

Food Hygiene And Safety Guidelines Hygienic Food Rules Safety Rules

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Pin On Finance Advisory Companiesnext

Cbdt Order On Extension Of Due Date Of Itr Tar To 7th Nov 2017 Cbdt Further Extends The Due Date For Filing Inco Income Tax Income Tax Return Indirect Tax

Types Of Income Exempted From Income Tax In India Income Tax Income Income Tax Return

Llp Registration Limited Liability Partnership Private Limited Company Public Company

Income Tax Return Filing Online In India Income Tax Return Tax Return Income Tax

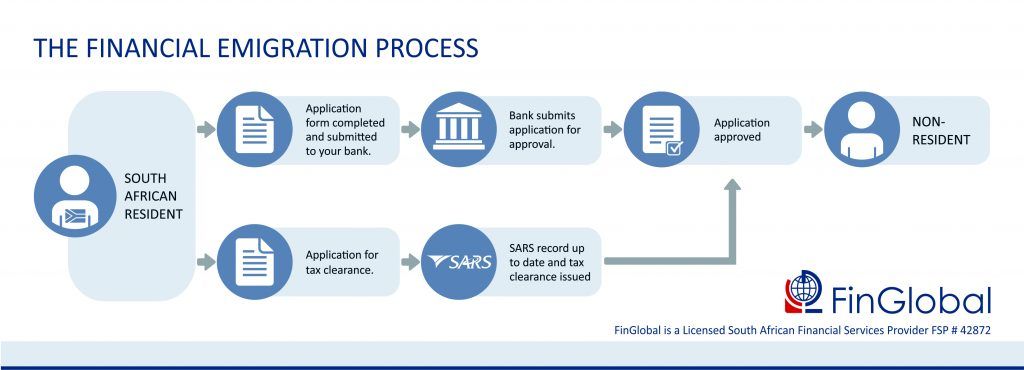

When Should You Consider Financial Emigration Emigration South Africa Financial

Top Mutual Funds Systematic Investment Plan Tax Saving Investment Mutuals Funds

When Should You Consider Financial Emigration Emigration South Africa Financial

Sujit Talukder On Twitter Income Tax Income Employment

Advance Tax How To Calculate Make Advance Tax Payment Online Tax Tax Payment Income Tax

Dissolution Reconstitution Of A Partnership Firm Section 45 4 Revised Section 45 4a Introduced Partnership Capital Account Cooperative Society